Reasons behind the Failure of Future Group

By Dr M.Rahman Oct 25, 2020 ..

..

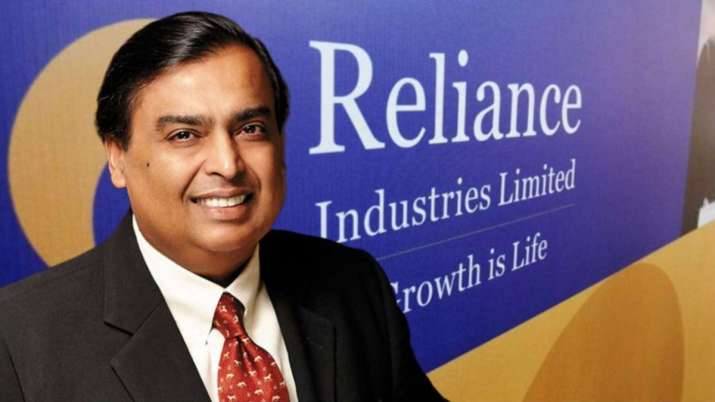

A proposed deal of selling of its complete stake in Future Retail to Mukesh Ambani’s Reliance Industries Ltd. for an amount of Rs 24,713 crore in August’2020 is seen as the biggest setback to Kishore Biyani, Founder and CEO of Future group and known as one of the best minds in retail business in India. But how did he come to this point? What were the reasons behind this situation?

Huge debt

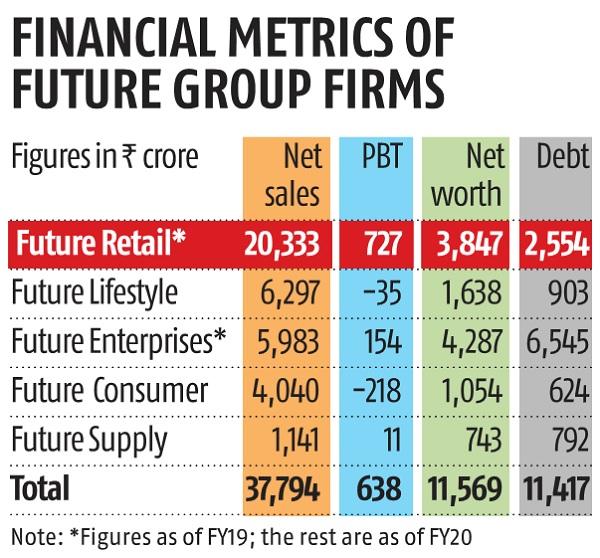

The revenue and profit figures mentioned in the previous page just says half the truth. In reality, Future Group has accrued heavy debt over the years and it was struggling to pay even the interest on the debt. As of September 30, 2019, debt at Future Group’s listed entities rose to Rs 12,778 crore from Rs 10,951 crore as on March 31, 2019 and the debt situation aggravated further in 2020. As per reports, RIL will take over debt and liabilities of over Rs 19,000 cr of Future group untill on March 31, 2020 as a part of the acquisition.

Biyani’s struggle with debt has a long history. With the success of Big Bazaar and the offline retail business, Biyani diversified into multiple verticals like financial services, insurance business, online retail etc. too quickly by taking on insurmountable amounts of debt while still struggling to steer the offline retail business.In FY12, he was in an identical 5000 crore debt soup, which forced him to sell his most valuable asset, Pantaloons Retail, to Aditya Birla group for Rs 1,600 crore. He also sold Future Capital to Warburg Pincus for Rs 4,250 crore. But, over years, the debt situation worsened and ultimately could not bear the load of huge debt that left him with no choice but to sell the business that could pay his debt.Hence, huge debt was one of the key reasons behind sell its flagship Future Retail to pay the mounting debts.

Aggressive expansion, Unrelated Diversification

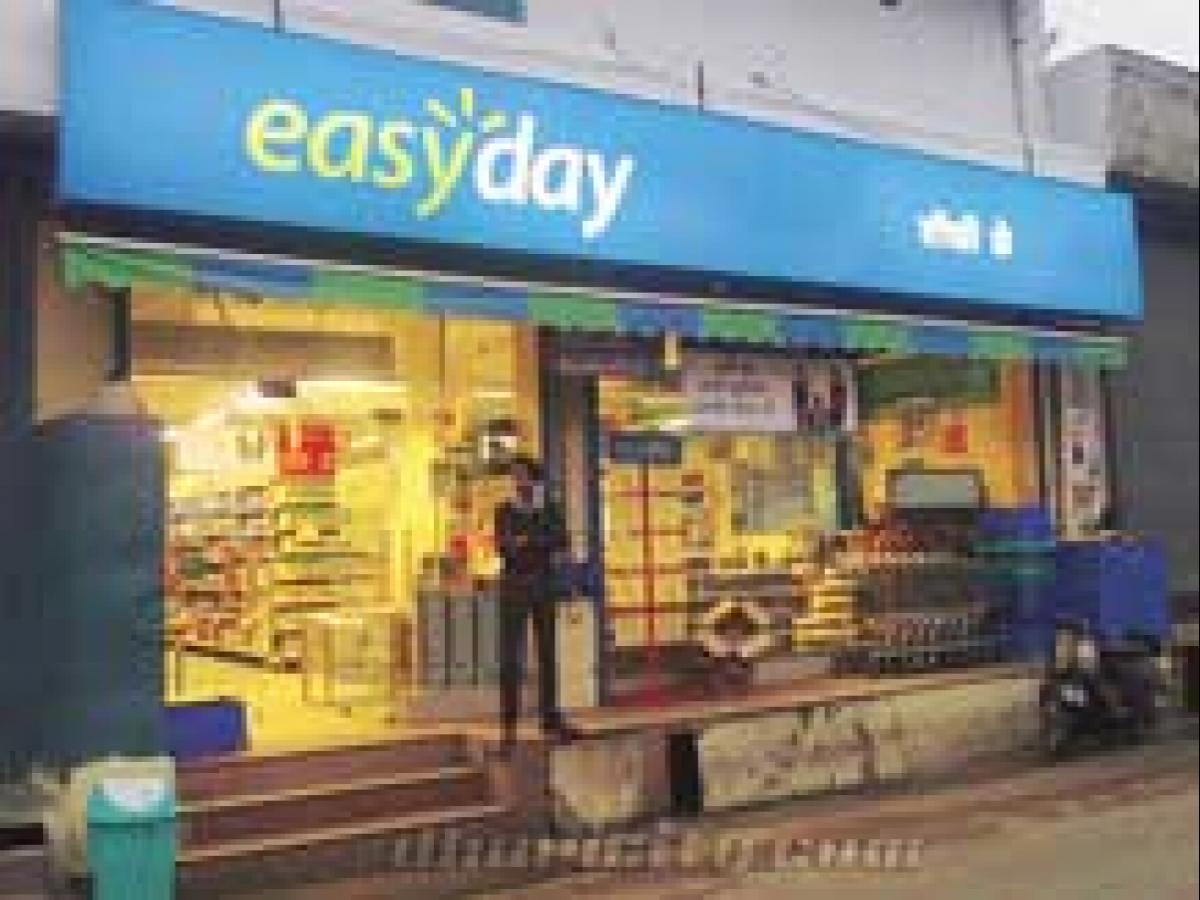

At corporate level, the group focused aggressively on expansion organically as well as inorganically over years. It was a dream of Biyani to have its Big Bazaar store presence in every city of India and as a result Big Bazaar stotes were opened even in many cities/locations where it was not viable. The group was highly focused on grocery retailing across the nation. It acquired neighborhood format- Easyday stores from Bharti retail and Nilgiris stores to strengthen its retail presence in southern India. Biyani’s over-ambitiousness in core retailing and his focus on acquiring these neighborhood format stores backfired. He invested heavily on these ventures but they did not succeed.  ..

..

Moreover his excitement about the group’s FMCG business, Future Consumer particularly proved infectious. He dreamt of scaling up the Rs 2,000 crore business to Rs 20,000 crore by 2021. But the company faced losses, resulting in 11.24 per cent decline in its profit in the first nine months of FY2020. .

.

It was also engaged into related as well as as unrelated diversification thereby entering multiple businesses ranging from insurance, logistics, etc. In the Retail summit in 2019, Kishore Biyani had admitted that the group had diversified into many categories over the years with limited success in some of them. Future Group founder and CEO Kishore Biyani accepted it was a mistake and the company would now restrict itself to food, fashion and home furnishings verticals. But, it was too late.

Inability to leverage online retailing

Kishore was never a big supporter of online retailing and he was critical in his assessment of e-commerce valuations and had once said nobody understands the economics and the more losses one makes the more valuations they get. “The cost of acquiring a customer in e-commerce is 11-20 percent, the cost of discovery and doing a transaction is 8-10 percent, the cost of fulfilment is another 11-20 percent. I believe this model doesn’t work especially in a country like India where 30 percent of fulfilment is internal debt and the margin that you operate on is very less,” he added. .

.

Although Future group had launched futurebazaar.com way back in 2007, it was never meant to take on the online retail space as it did for offline retail space. And as result it was not successful. In 2013, the group tried its luck once again with Big Bazaar Direct. This time the approach was slightly different. He planned to use a franchisee-based model where prospective vendors (including kirana shops, medical stores, and insurance agents) personally visited customers and collected their orders using an electronic device. Big Bazaar was responsible for stocking inventory and fulfilling the delivery. And the franchisees were expected to do much of the selling. Unfortunately, the model never took off and Biyani had to shutter operation in 2016 after losing more money. Hence, poor leverage of the online retailing business seems to have taken a toll on future retail when customers were flocking to online stores provided by flipkart, amazon, Big Basket etc. from offline stores because of larger options to choose from, better price, more convenience and better service. In this competition, the online giants were the clear winners.

Corona-virus pandemic

The last nail in the coffin was the spread of corona virus (COVID-19) and prolonged lockdown across the country that added to the wounds of the homegrown retail major. It lost nearly Rs 7,000 crore revenue in first three-four months of the COVID-19 pandemic due to closing of stores, which led Biyani to sell his business to Reliance Industries.There was no way the company could have survived losing such an amount with no sight of normalcy for the next few months. So, sellout to a business giant that could give a better deal was the only option left before Biyani’s Future group.