Adani Bubble Burst? From Global Rank 3 to 21 in Just Ten Days

Dr M Rahman, Senior academician, Business Management

Ever since Bloomberg Billionaires Index declared Indian Billionaire Gautam Adani as the third richest person in the world in Aug’ 2022, there have been a lot of discussions among business experts and on social media on whether the billionaire’s rank would be sustainable given a lot of controversies floating around his business empire.

Business experts discussed on the government favor, huge debt of over Rs 2 trillion ($25 billion) on which Adani’s business empire was built, and group companies’ highly inflated stocks that were considered just like a bubble.

Fitch rating’s CreditSight had reported in Aug 2022 that Adani Group is “deeply over leveraged”, and may, “in the worst-case scenario”, spiral into a debt trap and possibly a default. In other words, Adani Group’s debt is unsustainably high against its equity. This report made a small dent in Adani’s stock.

Adani Bubble Burst?

But finally, within six months, the Adani bubble burst after the release of a report ‘Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History’ on 24 Jan 2023 by a US based Investment research and short selling firm, Hindenburg Research. The report, prepared after two years investigation, accused the Adani Group of brazen stock manipulation and accounting fraud scheme over the course of decades.

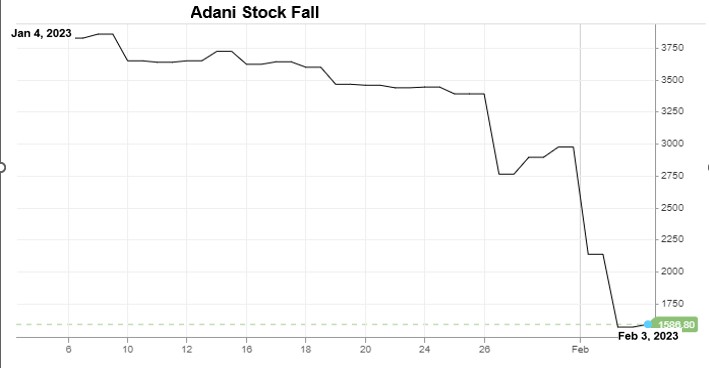

The report brought a Tsunami in the stock market and Adani group companies’ stock price tumbled like a pack of cards wiping out around Rs 9 lakh crores ($108) billion market cap in ten days. In a day alone, shareholders saw their wealth dropped by Rs 1.3 lakh crore to Rs 10.4 lakh crore. As share prices tumbled, Adani fell from global rank 3 to 21 in just ten days as per Bloomberg.

The repercussions of the fall was visible in many areas. The bonds issued by Adani group companies as these dropped to distress levels in global trading, Citi group’s wealth unit announces that it would stop extending loans against Adani shares. S&P lowered the ratings of two Adani group companies to ‘negative’ from ‘stable’.

The Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) accused of doing favour to Adani group companies have also came into action from the inactive mode. The opposition parties in India is questioning the functioning of government agencies and is demanding a thorough investigation from a Joint Parliamentary committee on Adani group’s businesses.

Looking at the above happenings, in my opinion it would be tough for Adani group to reach its previous position despite strong support from the Indian government. Moreover, it’s future also depends upon the accuracy of the Hindenburg’s report.

What’s your opinion?

External links

https://hindenburgresearch.com/adani/

Also read Why the Retail Giant Future Group Failed

2 thoughts on “Adani Bubble Burst? From Global Rank 3 to 21 in Just Ten Days”

Good one. Businesses will learn lessons that they can remain high if there is substance.

Adani’s defence report stating “it’s a war on India & nationalism angle ” is childish! Capital market & scams shouldn’t be justified by such statements.

Very informative blog sir